do nonprofits pay taxes on utilities

While most states wont require nonprofit organizations to pay the. If they hire employees they also have the responsibility for payroll taxes just like any business.

Transportation Utility City Of Wisconsin Rapids

The catch is that if you are considered a responsible person at a non-profit you.

. Taxes Nonprofits DO Pay. They must pay payroll tax all sales and use tax and unrelated business income. Nonprofit Organizations and Sales and Use Tax.

OK the operating principle behind a non-profit is that there is very little profit if any at the end of the year. Yes Tax-Exempt Non-Profits Must Pay Payroll Taxes. Nonprofit organizations must apply for exemption with the Comptrollers office and receive exempt status before making tax-free purchases.

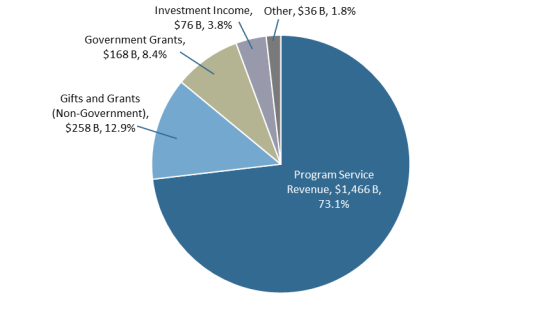

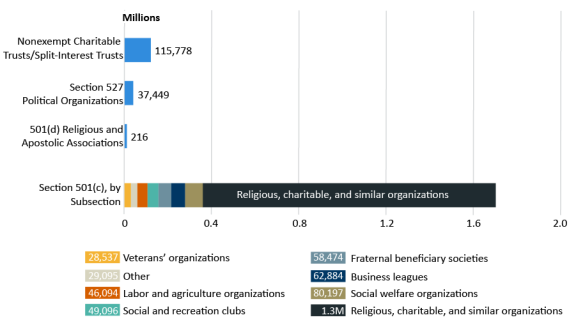

Also very often they depend on donations for sustenance and upkeep instead of selling items for a profit. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. Many nonprofit and religious organizations are exempt from federal and state income tax.

Taxability of rental income is fact-and-circumstance driven so. It is important to follow the proper steps to elect tax-exempt status. Very often the only taxes we do not pay are property taxes.

Because most of these. But there is no similar broad exemption from sales and use tax in places like California. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

Answer 1 of 2. Nonprofits and churches arent completely off of Uncle Sams hook. New Sales-Tax Rules for Nonprofits.

Failure to file the exemption can cause the company to have tax liability. Although it varies by location many states counties and municipalities make allowances for registered charitable organizations to either not pay property taxes or to have the property taxes they pay reimbursed. The research to determine whether or not sales tax is due lies with the nonprofit.

As long as they already have incorporated nonprofit organizations often do not have to pay property taxes. There are many terms and conditions that come with gaining 501c3 status. To be tax exempt most organizations must apply for recognition of exemption from the Internal Revenue Service to.

Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated business income tax reporting for tax-exempt entities under Internal Revenue Code Section 501 c 3. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount.

However this corporate status does not automatically grant exemption from federal income tax. Employees collecting a payroll check from a nonprofit or church are just as liable as the rest of us making a living. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes.

The IRS defines an educational organization very narrowly. UBI can be a difficult tax area to navigate for non-profits. To be tax exempt you must qualify in the eyes of the IRS.

Yes for this reason. Non-Profit Corporations Non-Profits are named as such because their goal is to not turn a. Not only will the employee pay their share of taxes.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Federal and Texas government entities are automatically exempt from applicable taxes. Generally a nonprofits sales and purchases are taxable.

As it turns out non-profits must follow more than the tax law when it comes to being an exempt entity. For example renting office. It must be an education-based 501 c3 nonprofit with a permanent building and full-time.

Sales of utilities such as gas electricity telephone services telephone answering services and mobile telecommunications services. You do not have to collect sales tax on sales to an organization that is exempt from having to pay sales tax but you. Even though the federal government awards federal tax-exempt status a state can require additional documentation to.

Tax-exempt nonprofits are 501c3 organizations. Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases. Although telephone tax is an excise tax most nonprofits pay according to the IRS it is reimbursable only to educational organizations governments and nonprofit hospitals.

Florida law grants certain nonprofit organizations that meet the criteria described in Section 21208 7 Florida Statutes FS and certain state-chartered financial institutions described in Section 21312 2 FS an exemption from Florida sales and use tax. Any nonprofit that hires employees will also need to pay employee taxes like Social Security Medicare and in some cases Unemployment Taxes. There are clear rules as well as several exceptions to.

Some nonprofits are tax exempt meaning they do not have to pay federal corporate income tax. All owners of land and buildings in a communitywhether for-profit or nonprofit entitiesuse the basic services provided by their city or county. Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing tangible personal property in furtherance of their organizational purposes.

What qualifies a nonprofit for tax exemption. Because the point of a nonprofit is to not make a profit the entity can elect to be tax exempt. However organizations that have an E number are liable for excise taxes such as the Electricity Excise Tax.

Sales Tax Considerations For Nonprofits

Printable Free Cash Flow Forecast Templates Smartsheet Cost Forecasting Template Pdf Cash Flow Budget Forecasting Personal Finance Budget

Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com

Nonprofits Don T Have To Pay Taxes But Boston Still Hopes They Ll Chip In

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Five Rules For Buying A House And How Far You Can Bend Them Buying A New Home Life Hacks Home Improvement

Tax Filing Requirements For Nonprofit Organizations

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc

Taxing Nonprofits Changes In Unrelated Business Income Tax Pro Center Intuit

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Nonprofit Charitable Tax Exemption Pennsylvania Association Of Nonprofit Organizations

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

Which Organizations Are Exempt From Sales Tax Sales Tax Institute

Do You Have To Pay Taxes On Emergency Rental Assistance

Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com