springfield mo city sales tax rate

Enter your street address and city or zip code to view the sales and use tax rate information for your address. Police Fire or EMS dispatch.

Find Sales and Use Tax Rates.

. The minimum combined 2022 sales tax rate for Springfield Missouri is. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the. Please note the following examples are based on.

17 rows Springfield compares or benchmarks itself to other cities in our size and region. Springfield is located within Greene County Missouri. Springfield in Missouri has a tax rate of 76 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Springfield totaling 337.

The base sales tax rate is 81. The average cumulative sales tax rate in Springfield Missouri is 782. Springfield Sales Tax Springfields sales tax is 81 which includes the following breakdown.

Missouri Department of Revenue 2018 For. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and. What is the sales tax rate in the City of Springfield.

Start a Development Project. City of Springfield Busch Municipal Building 840 Boonville Avenue Springfield MO 65802 Phone. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175.

For each and every month thereafter an additional two percent 2 of the license tax will be added until the tax is fully paid. Higher sales tax than 62 of Missouri localities 15 lower than the maximum sales tax in MO The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175. What is the sales tax rate in Springfield Missouri.

The tax continues to be 27 cents for 100 of assessed value. 417-864-1000 Email Us Emergency Numbers. This is the total of state county and city sales tax rates.

Indicates required field. The Springfield City Code Chapter 70 Article V requires hotels motels and tourist courts to pay a tax equal to 5 of the gross rental receipts. Missouri has state sales tax of 4225 and allows local governments to collect a local option.

You can find more tax rates. This includes the rates on the state county city and special levels. The current total local sales tax rate in Springfield MO is 8100.

Missouri MO Sales Tax Rates by City The state sales tax rate in Missouri is 4225. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. Notify Me Watch Live Meetings.

Over the past year there have been 98 local sales tax rate changes in Missouri. The total penalty will not exceed thirty percent 30 of the tax. With local taxes the total sales tax rate is between 4225 and 10350.

Did South Dakota v. Citizens Tax Oversight Committee.

Highest Gas Tax In The U S By State 2022 Statista

Use Tax Web Page City Of Columbia Missouri

Missouri Sales Tax Rates By City County 2022

Highest Gas Tax In The U S By State 2022 Statista

Setting Up Sales Tax In Quickbooks Online

Sales Tax On Grocery Items Taxjar

Missouri Sales Tax Small Business Guide Truic

Taxes Springfield Regional Economic Partnership

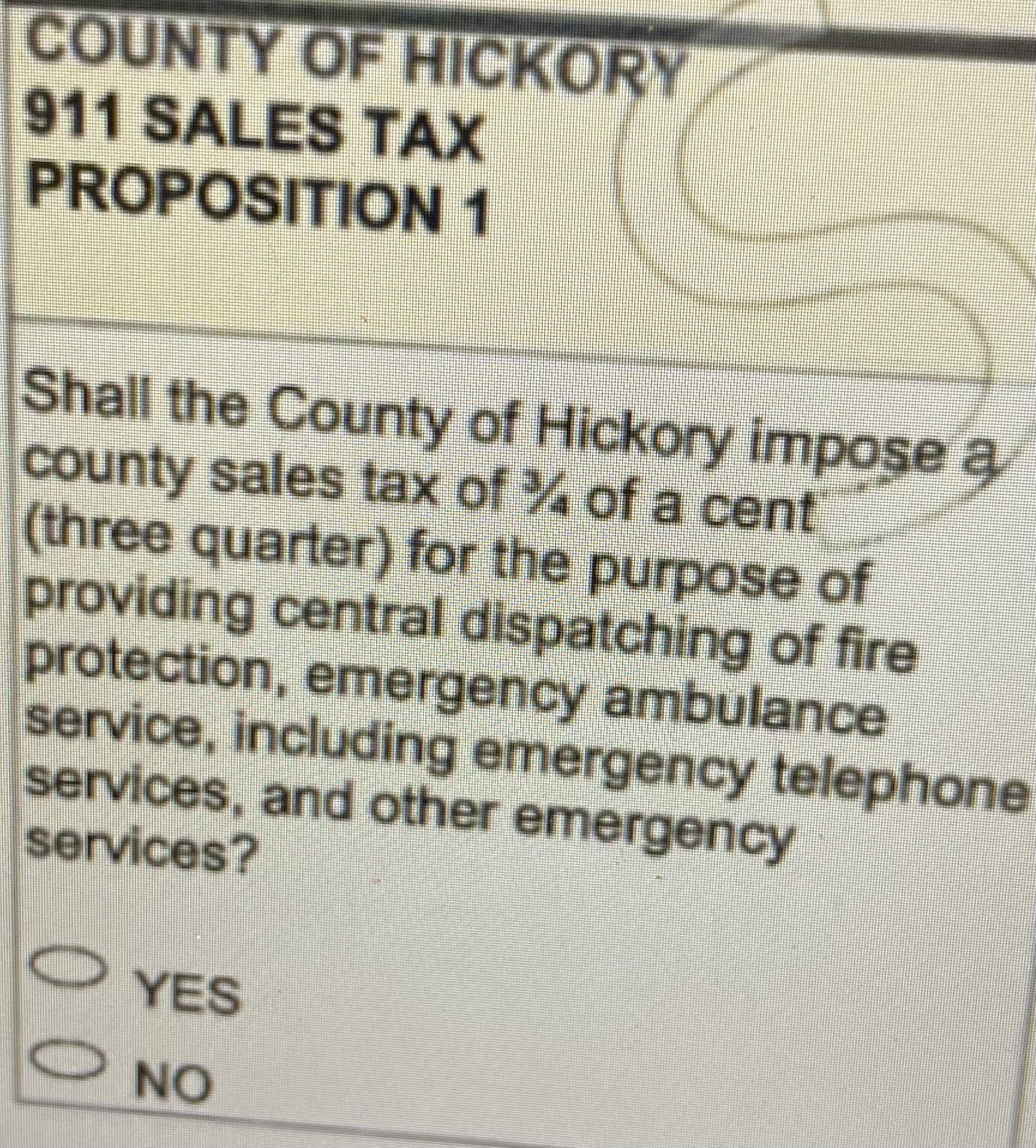

Hickory County Looking To Impose A 911 Sales Tax Causes Confusion With Residents

Michigan Sales Tax Guide For Businesses

Nebraska Sales Tax Rates By City County 2022

Missouri Car Sales Tax Calculator

Financial Reports Springfield Mo Official Website

Missouri Income Tax Rate And Brackets H R Block